Retail & Wholesale Insurance

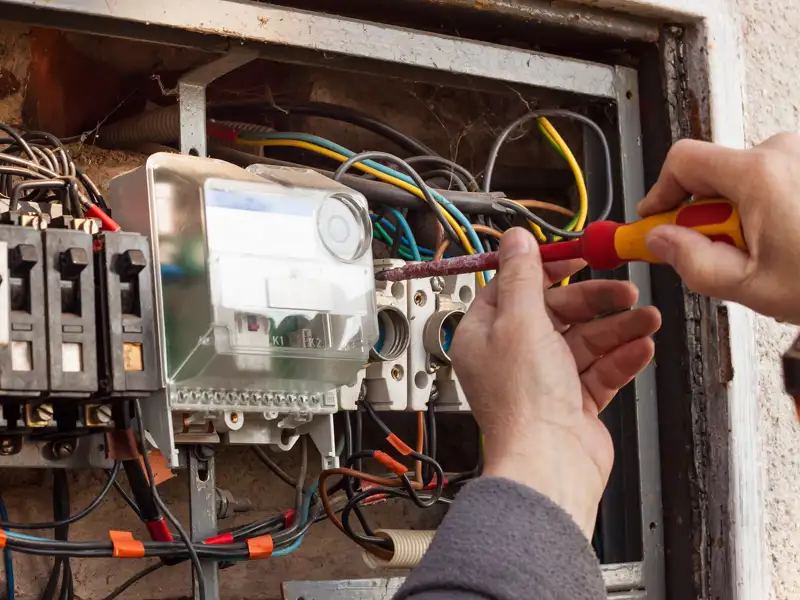

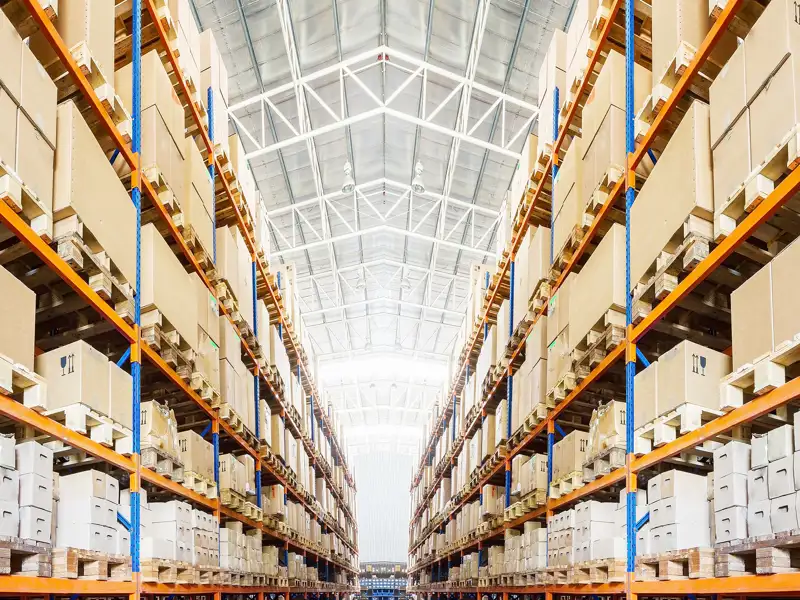

Being one of the largest sectors of the UK economy it covers many diverse and interesting businesses, which we recognise needs not just good levels of standard insurance cover but some bespoke understanding of each individual risk.

As a professional accountant for Hillier Hopkins LLP, my standards are very high. Not only in ensuring that my clients are happy and kept updated on any accounting changes affecting them, but also who I choose to give my business to or to congratulate and thanks.

From experience, personal and company image is so very important, and that is why JAMES JOHNSON of HILLIER HOPKINS LLP is very proud to acknowledge SUE EVANS and AIC Insurance and the excellent service they provide.

Recently my wife had a car accident and Sue was on hand to help and support with all the paperwork. This saved me a headache at a busy time of year.

Once again, thank you for caring so much and be assured that I would have no hesitation in recommending you to anyone and everyone in the future.

James Johnson

Every aspect of all the different insurances supplied were perfect, highly recommended.

Peter Jeffrey

Northampton

I can’t thank you enough for the professional way Joel Clements and all at AIC handled my request for Tring Corinthians F C cover, following More Than ceasing to continue covering us. You have provided via Aviva, exactly what we required plus an increase on our contents cover, for £197.00 less than last year. I am afraid I could not resist the pun that, MORE TH>N charged a lot “More Than” AIC have charged us for even better cover.

Alan Saunders

Tring Corinthians F C

I don’t often post reviews, but I wanted to say how great the team is at AIC. A very professional and friendly service is always given and even better they saved me money too!

Nick Quinlan

Hertfordshire

What to say about AIC, I have my all my insurance needs with AIC, very professional, extremely knowledgable, would recommend them to any of my fiends

Paul Noble

Hertfordshire

As a Business Advisor I need to act with complete integrity when working with clients, the relationship is one built on complete trust. I pride myself on being available and responsive to my client’s needs. As a result, when I refer people in to do a job, not only is it the referred party’s reputation on the line, but also my own.

Recently I have come across two contacts who needed Professional Indemnity and Public Liability insurance sorting out, and they needed it doing quickly. Both cases were different, one was exceptionally straightforward and the other was not without complications!

On both occasions I spoke to the clients and said I would put them into contact with Sue Evans of AIC and told them she would be in touch. Now, Sue is very passionate about insurance and really worries if people are not covered – as a result whenever I have passed her a referral she has always acted swiftly and with complete professionalism, and these two instances were no different. The easy one I know was sorted by her colleagues within a couple of hours of the initial introduction and the other one, whilst still ongoing for reasons outside of her control is going to go ahead.

Having Sue as part of my trusted network is not only valuable to me and my brand (she makes me look good) but having someone with her professionalism, knowledge and experience behind me is invaluable because I know if I have any questions I can just pick up the phone to her.

Without doubt I will continue to recommend Sue and her colleagues at AIC Insurance to my clients, friends and family alike for any insurance requirements they may have in the future.

Steve Bridson

Last year I gave Diamond Insurance Brokers the opportunity to provide an estimate for my business insurance. Which you did promptly and at a good price. Though you weren’t able to provide one of the elements which were integral to our business, therefore we had to decline at that time.

A year later, our renewal has come around again. I had a quick chat with you before we renewed again, and you expressed that you now have more buying power and therefore more options available now that Diamond has become part of AIC.

You were so right, I got everything I need and more.

I can’t thank AIC enough for helping me out, kudos to Joel who was exceptionally helpful, he explained the Personal Accident part of my existing Hiscox policy, which I thought was a real benefit, wasn’t worth the paper it was written on and more importantly, wasn’t what I thought it was. He then went on to explain that I should look at Key Man Insurance instead, to cover the loss of either director, both of whom are essential to the day to day running of the business.

And to top it all off, AIC saved me £150 per annum, not to be sniffed at all.

Thanks Sue, top job

Bevan Givens

Always a friendly and efficient service. I would like to thank AIC for all their help throughout the years.

Betty Purbeck

Hertfordshire

Insurance is a minefield. It is complex and can cost you a fortune. I called Sue and Rod at AIC. No issue is too big for them. They responded quickly and professionally and the quote was amazing. AIC is at the top of mind now when I talk to friends and family about insurance.

I highly recommend AIC team because they are professional and very competitive.

Peter McDonald

I can’t thank all at Advanced Insurance Consultants Ltd enough. Having previously dealt with on-line price comparison sites it was refreshing & reassuring to deal with friendly, experienced & knowledgeable staff who talked me through every aspect of my insurance. They found the right policy for me with no hidden extras or excesses and the biggest surprise was that they saved me money on my current renewal. I was always led to believe that a broker would be more expensive, this is clearly a myth and I urge anyone who is looking for insurance to contact Advanced Insurance Consultants.

Adrian Smart

North London

Thank you for your help and support organising insurance for our fleet. The work Scott did was 1st class and I felt very well looked after.

I will be looking for a broker to look at our business insurance in August 2021. Hope its ok if I approach you again.

Antony Didjurgis

They are always extremely friendly and very efficient. Always there to help you with any issues that arise. I could not recommend them more highly!

Patricia Seabright

Hertfordshire

The relationship AIC have built with my company means everything to me. Building trust and rapport are two key attributes AIC do very well. Taking the time to get to know me personally and my business is a great way to ensure they understand what I want.

Roy Newman

Hertfordshire

AIC Have come up with the right solution and pricing for our business and their staff have been very helpful with any enquiries we have made.

Andrew Williams

London

Simply the best service by far you will ever have, which I recommend to all

Amazing building ~ Friendly Staff ~ Great Rates

Ju Pop

Exeter

I came for Insurance at AIC Insure and it was a very simple and quick process, i would fully recommend AIC insure.

Adam Wheatley

Southampton

The relationship AIC have built with my company means everything to me. Building trust and rapport are two key attributes AIC do very well. Taking the time to get to know me personally and my business is a great way to ensure they understand what I want.

Roy Newman

Hertfordshire

It is so reassuring to find a company with good traditional customer service. There is always a person to talk through your requirements when you need it most. I have been insured with them for both business and personal for many years and have always found the staff very helpful. The rates quoted have been no more expensive than any offered from the ‘compare sites’. Claims have been managed for me without hassle. I can’t recommend them highly enough!!

Marjorie Metcalfe

Hertfordshire

Welcome to the home of Retail & Wholesale insurance from AIC

With our broad experience of the insurance market, we can professionally present your risk and find the most competitive market pricing for the required cover, and our specialist knowledge of these types of products ensures we can identify the right cover is granted for your individual needs.

Above we have divided our site into some general cover categories so you simply navigate to the type of policy you require, this can then identify the right member of staff from our end who has real experience in covering this type of risk and they will respond to you directly.

Insurance schemes

Need help?

Talk to one of our friendly consultants to assess you needs and find a bespoke insurance solution to suit your business.

How to make a claim

Whilst you normally have an emergency phone number stated on your policy documents, we always recommend talking to your account handler first.

Accreditations and Awards

That’s a tough question to answer without first establishing what cover you exactly need. Perhaps you want your premises covered, or maybe you just want the legal minimum cover required such as liability or vehicles? The good news is that we at AIC as brokers, have more insurers available on our panel than nearly any other firm, so we’re bound to find you the most competitive market price on whatever your insurance needs.

We’ll always recommend starting with a conversation with our helpful and friendly staff, so we can assess your needs and find the right bespoke insurance solution for you.

Good question, and it depends on exactly what type of business you are running. Perhaps you are only trading online, or you’re open to the public. One of the basic covers to start with would be Liability insurance, and this can be set to protect the Public, Employees or Products. Then there’s your premises which may include the building, business equipment and some stock perhaps.

Then there’s some professional insurances, such as Professional Indemnity or Directors & Officers, to cover the business and management against the advice it offers as part of its service. The list goes on and on, and our site lists most covers you might need, but even better give one of our experienced and happy staff at AIC a call to discuss your business in more detail.

Visit our main website page for Builders Merchants Cover and Quotes by clicking here.

There is no quick answer here, although it can be a lot cheaper than people think. For example Liability insurance for a tradesperson starts at under £75 for the year.

Firstly you should think about the risks, and what you want to cover, plus we can help you understand what your legal requirements are, so then your able to form an idea of what your overall cover requirement is. With this information we at AIC can quickly asses cost from our vast array of insurers, to get you the best market price.

Some parts of cover are legal requirements, such as the Liability cover section, but most of some insurance packages are just good business sense.

We at AIC can normally offer various cover packages, starting with just the bare bone legal requirements and then build up from there. But it’s often just as cheap to buy ‘off the shelf’ packages of cover that give a wide scope of protection for smaller businesses, than trying to isolate just what is the legal requirement. As always its best to talk to one of our friendly staff, so we can talk you through the options.

We at AIC always recommend to air on the side of caution, and disclose everything to ourselves, and we can help you decide if this information needs to be told to insurers, which normally it does.

There are different rules to follow from various sources, as an insurer may ask you to declare convictions in the last 10 years, whereas the rehabilitation act may dictate that you don’t need to declare it for more than say 5 years. DVLA may give you a different answer again for motoring convictions! Talk to one of our friendly consultants and let us help you.

Using a dedicated insurance broker provides benefits completely unseen when using a comparison site. With AIC, you’re afforded your own dedicated account manager who specialises in the cover you are seeking. Getting to know our clients is paramount to our customer service dedication and getting to know you AND your requirements is part of that. When you use a price comparison website, you are quite literally just a number and just a click-cost.

With any type of cover it is important to present insurers with all the information that will or could possibly affect the way they look at the risk. If this is not provided, insurers have the right to walk away from a claim, to change terms at the time of a claim, or reduce an amount paid depending on which law the insurance adheres to.

A good insurance broker (like AIC) should not be afraid to ask the right questions of a potential policy holder, or suggest ideas that will help in the risk management of the cover in question. Insurance is there to help you in the event of a problem, and it makes no sense to cut corners on something so important. We’re here to help you!

We hate call centres as much as you! Our phones will never be answered by a call centre and only by a staff member. You only deal with your allocated account advisor, so you know who you will be dealing with every time you need to reach out to us.

There are two main ways you can pay your insurance: the full sum to cover the next 12 months upfront, or in 12 monthly instalments over an annual period.

The major drawback to monthly payments is paying by instalment usually makes the total cost of cover higher than it would be if you paid in one go. This is because the insurance company is effectively lending you the money to pay the premium, so it will charge you what amounts to interest on the repayments you make across the year.

By paying In full you are clearing your entire payment all in one go, meaning the insurance company won’t have to lend you the money and you won’t be due any premiums on the loan.

Great question and one we can of course help you with! Business insurance premiums are arrived at by the analysis of your likeliness to have a loss. When you apply for coverage, your information will be analysed by an underwriter who is responsible for determining whether or not they will consider writing a policy for you. Each business has completely different circumstances and we highly advise you to get in contact with us so we can understand and advise in the best possible way.